RBI Monetary policy is a process of using the instruments of monetary policy by which the Reserve Bank of India maintains the market stability and economic growth of the nation by controlling the inflation rate, interest rate, and overall supply of money that is available to the nation’s banks, its consumers, and its businesses.

The primary objective of Instruments of Monetary Policy is to keep economic growth at a gradual rate that is neither too hot nor too cold. The economic growth rate should not up and down all of a sudden, it must be at a gradual rate.

Before going further first, we will have to understand the inflation, interest rate, and money flow.

Table of Content

What is Monetary Policy

RBI Monetary Policy is to maintain price stability while keeping the objective of economic growth by controlling the inflation rate, interest rate, and overall money flow.

Current Rates are:

| Indicator | Current Rate |

| CRR | 4.50% |

| SLR | 18% |

| Repo Rate | 6.50% |

| Reverse Repo Rate | 3.35% |

| Bank Rate | 6.75% |

| Marginal Standing Facility Rate | 6.75% |

| Standing Deposit Facility | 6.25% |

| Liquidity Adjustment Facility | 6.50% |

Inflation

Inflation is a continuous growth in the price level of a basket of selected goods and services. A continuous decline in purchasing power of a currency over a period of time is called inflation.

The prime objective of RBI monetary policy is to maintain inflation under control by using the instruments of monetary policy.

Interest Rate

Interest rate is a defined percentage of the principal amount that a lender applied to a borrower for the use of assets. It is not only applicable to the landing amount which was lent by banks to the borrower as a loan but also to deposits in banks like saving account deposits and fixed deposits.

RBI manages the interest rates like CRR, SLR, Repo Rate, Bank Rate, SDF, LAF, and many more by using the instruments of monetary policy.

Money Flow

The interest rate has a major role in Money Flow. When liquidity is needed in the market, RBI reduces the interest rates on loans as well as on deposits by using instruments of monetary policy, in a result of this more liquidity is being injected into the economy or market by all types of banks in India as well as people of the nation.

But vice versa when there is surplus money in the market, RBI increases the interest rate on loans as well as on deposits as a result of this surplus money being sucked from the market and gets deposited in banks.

Monetary Policy Committee Members

The monetary Policy Committee (MPC) was constituted by the Central Government under RBI Act, 1934 Section 45ZB Subsection 1. The prime objective of the Monetary Policy Committee is to determine the policy interest rate required to achieve the inflation target.

In other words, the objective of the monetary policy committee is to manage inflation, money flow, and interest rate by using the instruments of monetary policy.

History of Banking in India has evidence that interest rate has a major role in the money flow and inflation of the nation.

Urjit Patel Committee was the first committee that proposed the Monetary Policy Committee (MPC). RBI Monetary Policy Committee was set up on 27th June 2016. The committee suggested a five-member MPC – three members from the RBI and two nominated by the Government.

RBI Monetary Policy Committee came into force effective on 1st August 2016. Central Government appoints the Members of the RBI Monetary Policy Committee under sub-section (2) of Section 45ZB of the Reserve Bank of India Act, 1934.

The decision of the RBI Monetary Policy Committee shall be binding on the Banks.

The RBI Monetary Policy Committee shall consist of the following Members, namely:

(a) The Governor of the Bank—Chairperson, ex officio

(b) Deputy Governor of the Bank, in charge of RBI Monetary Policy—Member, ex officio

(c) One officer of the Bank to be nominated by the Central Board—Member, ex officio

(d) Three persons to be appointed by the Central Government—Members. These members will hold office for a period of four years or until further orders, whichever is earlier.

The Reserve Bank’s Monetary Policy Department (MPD) assists the MPC in formulating monetary policy.

Monetary Policy Committee:

| List of Monetary Policy Committee Members | Role |

| Dr. Shashanka Bhide | Senior Advisor, National Council of Applied Economic Research, Delhi |

| Dr. Ashima Goyal | Professor, Indira Gandhi Institute of Development Research |

| Prof. Jayanth R. Varma | Professor, Indian Institute of Management, Ahmedabad |

| Dr. Rajiv Ranjan | Head of Department of Economic & Policy Research, RBI |

| Dr. Michael Debabrata Patra | Deputy Governor |

| Shri Shaktikanta Das | Governor |

RBI MPC Meeting

The first meeting of the RBI Monetary Policy Committee was held on October 3 and 4, 2016.

RBI Monetary Policy Committee meetings must be done Bi-monthly and required to meet at least four times a year. This is the function of the Reserve Bank of India.

The quorum for the meeting of the RBI Monetary Policy has four members. The objective of the Monetary Policy Committee is to maintain the interest rate by using the instruments of monetary policy.

Final decisions in the RBI MPC meeting are taken by casting the vote of each member of the committee. A Committee of six members, after taking the final decision each member of RBI MPC has one vote. In the case of equality of votes, the Governor has the right to a second vote.

Minutes of the proceedings of RBI MPC are published on the 14th day from the RBI MPC meeting date, which include:

- The resolution adopted by the RBI MPC

- The vote of each member on the resolution

- The statement of each member on the resolution adopted

Once every six months, the Reserve Bank publishes a document called the RBI Monetary Policy Report to explain:

- The sources of inflation

- The forecast of inflation for 6-18 months ahead

Instruments of Monetary Policy

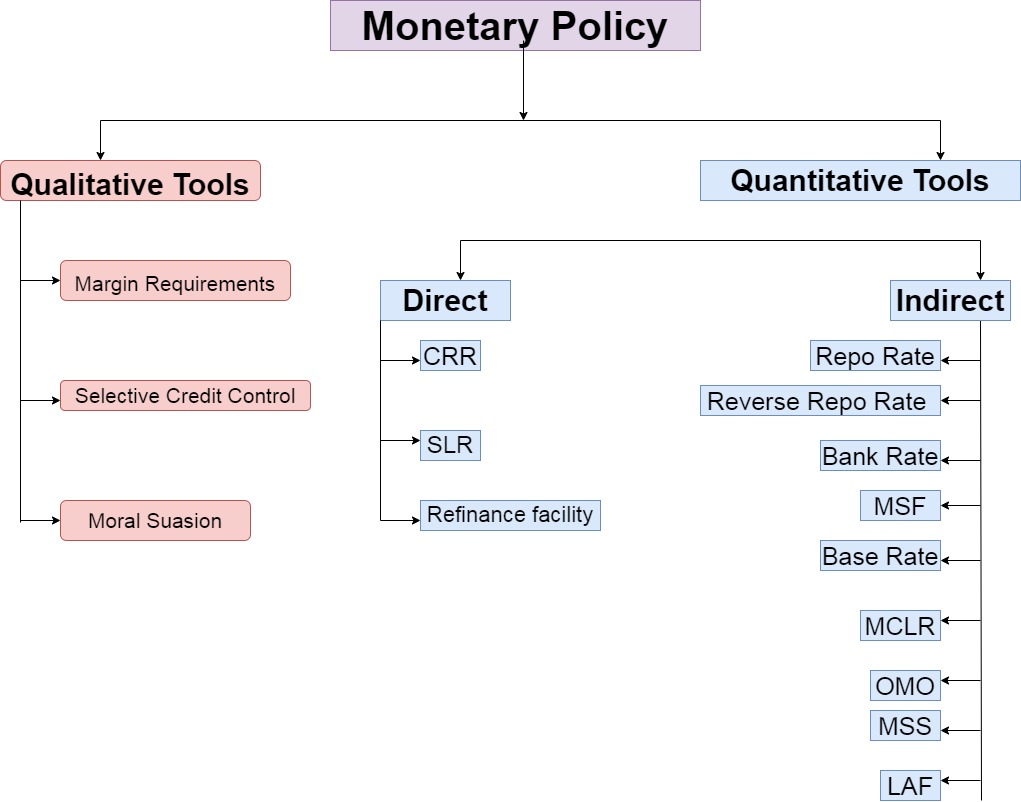

Instruments of monetary policy are divided into two categories qualitative monetary policy instruments and quantitative monetary policy instruments.

Qualitative Instruments of Monetary Policy

Qualitative Instruments of Monetary Policy have 3 tools.

- Margin Requirements

- Selective Credit Control

- Moral Suasion

(1) Margin Requirements

A margin requirement is a qualitative tool of monetary policy instruments of RBI. Margin requirement means Loan to Value. Loan-to-value (LTV) is the ratio of the loan amount to the actual value of the asset purchased.

Loan to Value = Loan amount / Actual value of an asset purchased

It can be understood by an example: If an individual wants to buy a car worth Rs 10 Lakh, and LTV is set at 70%. It means a maximum of 7 lakh Rs will be sanctioned as a loan.

Loan to Value = Loan amount / Actual value of an asset purchased

70 % Loan to Value = Loan Amount / 10,00,000

Loan amount = 70 % × 10,00,000

Loan amount = 7,00,000

(2) Selective Credit Control

Selective Credit Control is a qualitative tool of monetary policy instruments of RBI. In this instrument, RBI specially instructs the banks not to give loans to traders of certain commodities e.g. sugar, edible oil, etc. So that no one trader can hoard or speculate on any commodity.

(3) Moral Suasion

Moral suasion is a qualitative tool of monetary policy instruments of RBI. RBI interacts with banks through meetings, conferences, and media regarding certain economic trends say for example when RBI changes Repo Rate then RBI asks to reduce the base rates. RBI asks banks to reduce NPA.

Quantitative Instruments of Monetary Policy

Quantitative monetary policy instruments are divided into two parts. Whenever RBI makes any changes in instruments of monetary policy then all types of banks in India have to follow the guidelines.

(1) Direct Monetary Policy Instruments

(2) Indirect Monetary policy Instruments

(1) Direct Monetary Policy Instruments

Direct monetary policy instruments are those instruments that affect the money flow on an immediate basis say CRR, SLR, and Refinance rate. Those are implemented immediately after the RBI monetary policy meeting is held.

(1.1) Cash Reserve Ratio

Cash Reserve Ratio (CRR) is an RBI monetary policy instrument. Cash Reserve Ratio is a certain percentage share of Net Demand and Time Liabilities (NDTL) that a bank has to maintain with RBI in form of Cash on a daily basis.

No interest is paid on Cash Reserve Ratio by RBI because Cash Reserve Ratio is security money as liquidity. An increment in Cash Reserve Ratio draws money from the economy and a decline in Cash Reserve Ratio injects money into the economy.

All scheduled banks have to maintain Cash Reserve Ratio as per the provision of RBI Act, 1934 section 42(1) A.

Cash Reserve Ratio does not have any range of minimum (floor) and maximum (Ceiling). The current Cash Reserve Ratio is 4.50%.

Incremental Cash Reserve Ratio (ICRR): The Reserve Bank of India asked all scheduled banks to maintain an incremental cash reserve ratio (ICRR) of 10% with effective from 12 August 2023.

“Starting from 12 August 2023 all scheduled banks shall maintain an incremental CRR of 10% on the increase in their net demand and time liabilities (NDTL) i.e. between May 19 and July 28, 2023”

(1.2) Statutory Liquidity Ratio

The Statutory Liquidity Ratio (SLR) is an RBI monetary policy instrument. A Statutory Liquidity Ratio (SLR) is a certain percentage share of Net Demand and Time Liabilities (NDTL) that a bank has to maintain with itself in form of Cash, Government Securities, and Gold on daily basis.

An increment in Statutory Liquidity Ratio draws money from the economy and a decline in the Statutory Liquidity Ratio injects money into the economy.

As per the Banking Regulation Act, 1949 section 24, all scheduled banks have to maintain a Statutory Liquidity Ratio.

The Statutory Liquidity Ratio has a range of minimum (floor) 0% and maximum (Ceiling) 40%. The current Statutory Liquidity Ratio is 18%.

(1.3) Refinance Facility

Refinance Facility is an RBI monetary policy instrument. RBI offers to refinance facility to help the exporters. It allows scheduled commercial banks (except Regional Rural Banks) to refinance up to 1% of the Net Demand and Time Liabilities (NDTL) of each bank.

(2) Indirect Monetary Policy Instruments

Indirect instruments of monetary policy are those instruments that affect the money flow over a period of time.

(2.1) Repo Rate

Repo Rate is an RBI Monetary Policy instrument. Repo Rate is an interest rate at which the Reserve Bank lends short-term money to commercial banks against the collateral of government and other approved securities.

Reserve Bank provides landing for up to 90 days only. The current Repo Rate is 6.50%. At every RBI monetary policy meeting, it is reviewed.

(2.2) Reverse Repo Rate

The Reverse Repo Rate is an RBI Monetary Policy instrument. A Reverse Repo rate is an interest rate at which commercial banks deposit their surplus money with the Reserve Bank is called Reserve Repo Rate.

The current Reverse Repo rate is 3.35%.

(2.3) Bank Rate

The bank rate is an RBI Monetary Policy Instrument. Bank Rate is the interest rate at which the Reserve Bank is ready to buy or re-discount a bill of exchange or other commercial papers for a long period of time.

RBI Act, 1934 section 49 describes the Bank Rate. The current Bank Rate is 6.75%.

(2.4) Marginal Standing Facility

Marginal Standing Facility is an RBI Monetary Policy Instrument. It is a window for commercial banks to borrow money from RBI in an emergency situation overnight, by dipping into their Statutory Liquidity Ratio (SLR) portfolio up to a limit at a penal rate of interest.

The marginal Standing Facility is equal to the bank rate which is 6.75% presently.

The minimum Marginal Standing Facility amount is 1 Crore or multiple of it.

The maximum Marginal Standing Facility amount is 2% of NDTL.

Marginal Standing Facility is available on all working days. The marginal Standing Facility was started on May 9, 2011, by RBI.

(2.5) Open Market Operations

Open Market Operation is an RBI Monetary Policy Instrument. Open Market Operation is all about selling and buying securities through RBI to control the liquidity of the market.

(2.6) Market Stabilisation Scheme

Market Stabilisation Scheme is an RBI Monetary Policy Instrument. Market Stabilisation Scheme is an instrument for controlling the surplus liquidity by absorbing through the sale of short-dated government securities and treasury bills.

The Market Stabilisation Scheme instrument for monetary management was introduced in 2004.

(2.7) Liquidity Adjustment Facility

The Liquidity Adjustment Facility (LAF) is an RBI Monetary Policy Instrument. The liquidity Adjustment Facility (LAF) was introduced on the recommendation of the Narasimhan committee in June 2000. Liquidity Adjustment Facility (LAF) works on overnight auctions as well as term repo auctions.

LAF is a facility provided by the Reserve Bank of India to scheduled commercial banks to avail of liquidity in case of need or to park excess funds with the RBI on an overnight basis against the collateral of government securities.

In the LAF term, a repo auction has a tenure of 7 days, 14 days, and 28 days. The Term Repo rate is equal to the Repo rate is 6.50%.

LAF is processed by RBI on its CBS portal named as eKuber, only on Friday from 02:30 PM to 03:00 PM.

RBI accepts applications for a minimum amount of 5 Crore or a multiple of 5 Crore thereafter.

RBI can process the LAF for a maximum amount of 0.75% of Net Demand and Time Liabilities.

Reference: “MPC RBI Report“

Reference: “RBI Rates“

Reference: “Monetary Policy” Wikipedia